Earlier this year, Forbes released its annual ranking of the world’s 2000 biggest public-traded companies. 13 South African companies made the list. According to South Africa based Businesstech, Forbes’ 2,000 biggest companies listing is calculated by analyzing listed companies from across the world and ranking the top 2,000 in four categories: sales, profits, assets and market value. Each company is given a score based on where they place on each respective list, and the final top 2,000 list is compiled based on a final, aggregated score.

The South African economy is often considered the most developed economy in Africa, so it is with little surprise that they had the most representation on the list among other African nations. Interestingly, when you review the annual reports of these companies, the recurring theme is that expansion outside of South Africa, or Rest of Africa (ROA) as it is often referred to, remains an important part of their strategy as they pursue long-term profitability and sustainability. There are countless reports backed with extensive research that point to the growth potential of the ROA economy. These top 13 companies in South Africa are capitalizing on the ROA opportunity and their continued positive shareholder returns are measurable evidence of their success.

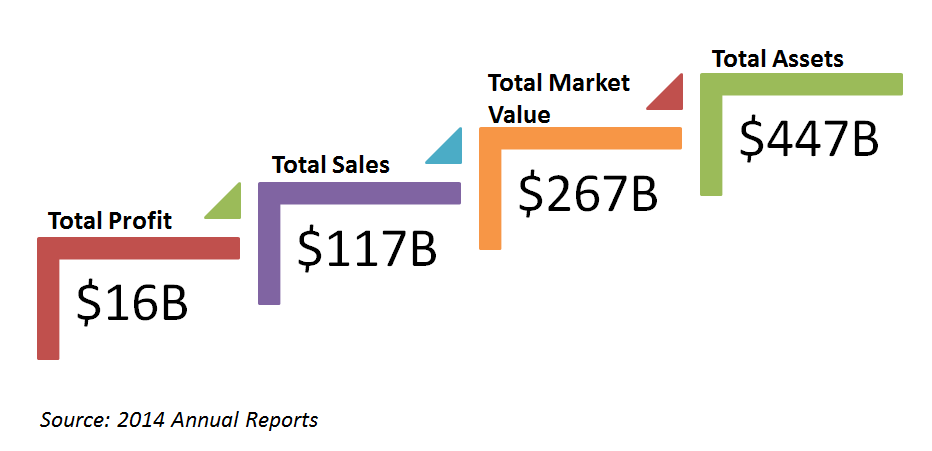

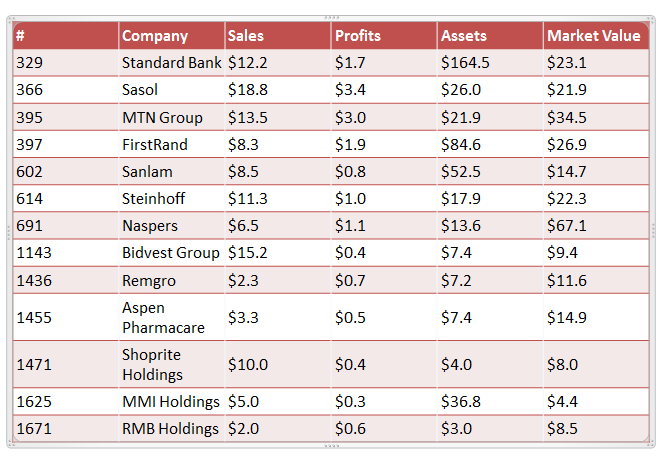

Here are some combined financial facts of the top 13 South African companies from the list:

One positive observation about the 13 companies that made the list is the fact that they play in different or multiple industries which is an unequivocal indication that the African economy is progressively becoming more diverse. Below are 7 audacious quotes from CEO’s of the top 7 out of 13 companies that made the Forbes list. The underlying denominator in all these quotes is that Africa is beyond ripe for investments and every one of these companies are making investments to take advantage of the Africa opportunity. Also, if you read these quotes through a keen entrepreneurial lens, you will quickly realize that even though these companies are fully committed to executing their strategy, many opportunities does still exist for innovative startups and small businesses willing to think outside the box.

- “The strong economic growth profile of our African markets beyond South Africa is well-documented and continues to underpin our belief in Africa’s potential. In particular, growth in sub-Saharan Africa over the last decade has increased the number of bankable businesses and households, as well as levels of household income. Furthermore, the financial markets in the rest of Africa are less developed than those in South Africa, with far higher growth potential.” – Ben Kruger and Sim Tshabalala, Co-CEOs of Standard Bank

Hanging metal sculpture of the Africa continent at the Corporate HQ of Standard Bank in Johannesburg.

Hanging metal sculpture of the Africa continent at the Corporate HQ of Standard Bank in Johannesburg.

- “It is undeniable that the coordinated changes we have made in the last three years have culminated in a Sasol that looks and feels very different. The work we have done, and are still doing, is about organizing ourselves for a new era. It is about a new way of working; it is about being less bureaucratic, more specialized and flexible; it is about moving forward as a more effective, efficient and competitive organization. It is all these things, which ultimately will enable Sasol to excel and endure long into the future.” – David E Constable, President and CEO of Sasol

- “In emerging markets, relatively low levels of internet penetration and limited offerings from over-the-top (OTT) players provide an opportunity for mobile operators to participate in the internet services space. The International Telecommunication Union, a United Nations agency, estimated that, in 2014, worldwide mobile subscriptions would reach seven billion, surpassing the world’s population, and that Africa would have the strongest growth in mobile uptake as well as the lowest mobile and internet penetration rates. Herein lies significant opportunity for MTN.” – Sifiso Dabengwa, Group President and CEO of MTN Group

- “Where technology is likely to play out strongly in financial services is on the broader African continent. Recent international research by the MEF, a UK-based mobile content and commerce trade association, indicates that globally mobile banking is the highest in Africa, led by Nigeria, South Africa and Kenya. There is much debate about the value of a large physical footprint given the rapid penetration of mobile technology. However, there is no simple answer. On the one hand, yes physical footprints come with massive cost structures and it seems to make sense that branches could be redundant in the digital era. However there are a few important things to consider; firstly, many emerging economies remain predominantly cash based so branches still perform an important function for the depositing and storing of cash. This will take many decades to change. Secondly, smart devices remain unaffordable for hundreds of millions of people on the continent, this too will take a long time to change.” – Sizwe Nxasana, CEO FirstRand Bank

- “The continued success of the diversification and internationalisation drive of the Group, in line with its strategy, must once again be credited for the solid performance of all the Sanlam businesses. The next step in this strategy will be to consolidate this portfolio of investments into a truly international company, which will enable the Group to unlock value by extracting synergies through collaboration. One of several steps towards this goal was the agreement between Sanlam Emerging Markets and Santam towards the end of 2013. This has resulted in the expansion of the Group’s general insurance footprint in emerging markets from six general insurance companies in 2013 to 11 at the end of 2014.” – Desmond Smith, Chairman of Sanlam (Desmond is not the CEO, the CEO of Sanlam is Johan van Zyl)

- “JD Group is one of the largest furniture and household goods retailers in southern Africa, and has diversified its retail offering further to include do-it-yourself (DIY) and automotive products…The diverse industrial businesses in KAP are well positioned to continue to benefit from the infrastructural growth in Africa.” – Markus Jooste, CEO Steinhoff International

- “Generally, platform businesses are the most valuable in media and the internet – consumer destinations (starting points) with repeat use and positive word-of-mouth. Platforms often deliver attractive financials on the back of this strong position with consumers. Executed well, the consumer base and cash flow from a strong platform can support the growth of valuable adjacent businesses.” – Bob van Dijk, CEO of Naspers (Naspers is a broad-based group with operations in ecommerce (especially online classifieds, etail, marketplaces, online services and payments) and other internet services, video entertainment and print media.)

South Africa’s biggest companies (US$ billions)

Source: Forbes.com