by Chuki Obiyo and Ozii Obiyo

INTRODUCTION

What is the most interesting thing that you have done, seen, or heard about investing in Africa? Think about it. Better yet, this e-book gives unique insight into how others have thought about it. From executives at some of the largest companies in the world to young professionals just starting out in their new careers, the topic of investing in Africa makes for a good debate and an even better conversation.

In the course of human history, Africa has gone from the cradle of civilization to the last frontier of the global economy. Ah…Ah…Africa, the protagonist of the first and next chapter in the story of human success? To read about Africa is to learn about our shared origin, and more importantly, to decide on how we get to our shared future. Reading is an investment in time, thought, and action. This book gives you an opportunity to invest in Africa by experiencing the most interesting things others have done, seen, or heard about investing in Africa.

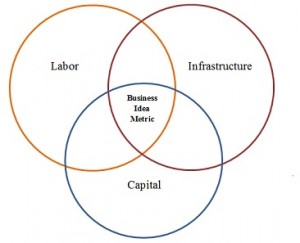

There are so many things to learn about investing in Africa. This book explores some of the most interesting things contributed by people from different backgrounds. Each contributor was asked to answer a series of questions about an African investment project broken down into three sections: Situation, Action, and Result. In turn, we developed our proprietary methodology to analyze each project and we refer to this methodology as the Business Idea Metric (BIM). The BIM uses a weighting scale to evaluate the labor, infrastructure, and capital requirements for an investment idea or project.

For the labor requirement, we look at factors such as low, medium, or high skill and assign a value of 10, 30, or 50 accordingly.

For the infrastructure requirement, we examine factors such as electricity/utilities, construction permits, property registration, transportation, and technology, and attach a value of 10 for each factor accordingly.

For the capital requirements, we consider the amount of capital needed to get the project off the ground from $0-100, $101-1000, $1001-10,000, $10,001-100,000, and over $100,000 and assign values of 10, 20, 30, 40, 50 based on the given spend levels.

We have received very positive feedback on our BIM methodology and its LIC (labor, infrastructure, capital) ingredients as a unique way to not only evaluate current projects but to also help prioritize future project ideas for viability. Please see below for one of the investment projects that we profiled from our work. In this write-up, we classify each profile by the contributor’s name (so please continue to watch this space for more project profiles).

We now welcome you to enjoy the reading experience of exploring the most interesting things about investing in Africa.

★★★★★

Wasili Mfungwe, MBA

***

Wasili Mfungwe, MBA is an international market analyst and consultant with expertise in economic research, ALM, stress testing, equity research, and business intelligence. He obtained a Bachelor’s of Social Science Degree in Economics and Sociology (Bsoc Eco) from the University of Malawi, Chancellor College and his MBA from Edinburgh Business School (Heriot-Watt University). He has particular interest in African business development, research, and econometrics.

Investment: Restructuring a corporate loan to promote a public good

SITUATION

Electricity Supply Corporation of Malawi (ESCOM)– the main electricity generator and distributer in Malawi had a loan with Development Bank of South Africa (DBSA) to the tune of MK3 billion (R79 million). The repayment of the loan was hampering the implementation of a program to revamp Malawi’s energy sector in order to provide more reliable electricity, create better non-outsourceable jobs, and improve the lives of everyday Malawians.

ACTION

Standard Bank Malawi Limited stepped in to restructure the loan which ESCOM owed to DBSA. The DBSA loan was secured by a zero coupon note issued by Investec in favor of ESCOM with a maturity value equal to the loan principal. Standard Bank ensured that ESCOM was able to get the highest discounted value for the note which, as part of the restructuring, was being sold before its maturity in June 2019. Standard Bank also advised ESCOM on the various structuring options and negotiated with DBSA and Investec on behalf of ESCOM, discounting the promissory note through its structured sales team and using the proceeds to partially repay the loan. Through its global markets team, Standard Bank built and remitted a total of R37.5 million on behalf of ESCOM to repay the outstanding amount of the loan. Standard Bank’s Investment Banking team structured and negotiated the prepayment with DBSA without any break costs being applied.

“Public-private partnerships should become the rule, not the exception, in delivering services.”

– Bill Clinton, 42nd President of the United States from 1993 to 2001

RESULT

The transaction has helped to engineer a smooth implementation of the energy sector revamp program. In addition, Standard Bank ensured that ESCOM saved R1.5 million in interest payments per month, leading to improvements in its free cash flow position. The transaction has also helped eliminate forex and interest rate risk for ESCOM.

Investment: Restructuring a loan to a corporation to promote a public good

L = 50

I = 50

C = 50

Business Idea Metric: 150

We want to hear your unique story and a unique story of someone in your network. Send us a note here.

Hanging metal sculpture of the Africa continent at the Corporate HQ of Standard Bank in Johannesburg.

Hanging metal sculpture of the Africa continent at the Corporate HQ of Standard Bank in Johannesburg.